new mexico solar tax credit 2020

For property owners in New Mexico perhaps the best state solar incentive is the states solar tax credit. Credits may apply to the Combined Report System CRS gross receipts compensating and withholding taxes and to annual corporate and personal income taxes.

Oe Solar Epc Community Solar Commercial Solar

The recently passed New Mexico Solar Market Development Tax Credit or New.

. New Mexico provides a 10 personal income tax credit up to 9000 for individuals sole proprietorship businesses and agricultural enterprises who purchase and install certified. New Mexico state solar tax credit. To help achieve this New Mexico has a state tax credit to incentivize homeowners to go solar.

The New Solar Market Development Income Tax Credit. This incentive can reduce your state tax payments. The credit disappeared for four years but was reinstated in 2020.

Click New Solar Market Development Continue Enter up to three credit certificates and the amount of credit applied to tax. 2020 marks the beginning of a new state tax credit policy and some changes have been made. The new solar market development tax credit may be claimed by a taxpayer who files a New Mexico personal or fiduciary income tax return for a tax year beginning on or after January 1.

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit. New Mexico state tax credit. In 2020 New Mexico lawmakers passed a statewide solar tax credit called the New Solar Market Development Income Tax Credit.

Or solar-heat-derived qualified energy resource the amount of tax credit varies based on the tax year following the date Page 1 of 3. Upload Application Please review the above list before you upload your documentation to make sure youve completed all forms required in the tax credit application package. It covers 10 of your.

Schedule PIT-CR is used to claim non-refundable credits. This area of the site. Solar Market Development Tax Credit SMTDC EMNRD is in the process of reviewing the provisions in the amendments made to the New Solar Market Development Tax Credit during the 2022 legislative session and will develop new rules.

Please see our Public Notices page for. In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was. Non-refundable credits can be used to reduce tax liability but if the tax due is reduced to 0 the balance of these credits is not.

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Average Solar Panel Cost Per Kwh In 2022 Solar Com

To Expand Solar Energy New Mexico Government Renews Tax Credit

Federal Solar Tax Credit 2022 How Does It Work Adt Solar

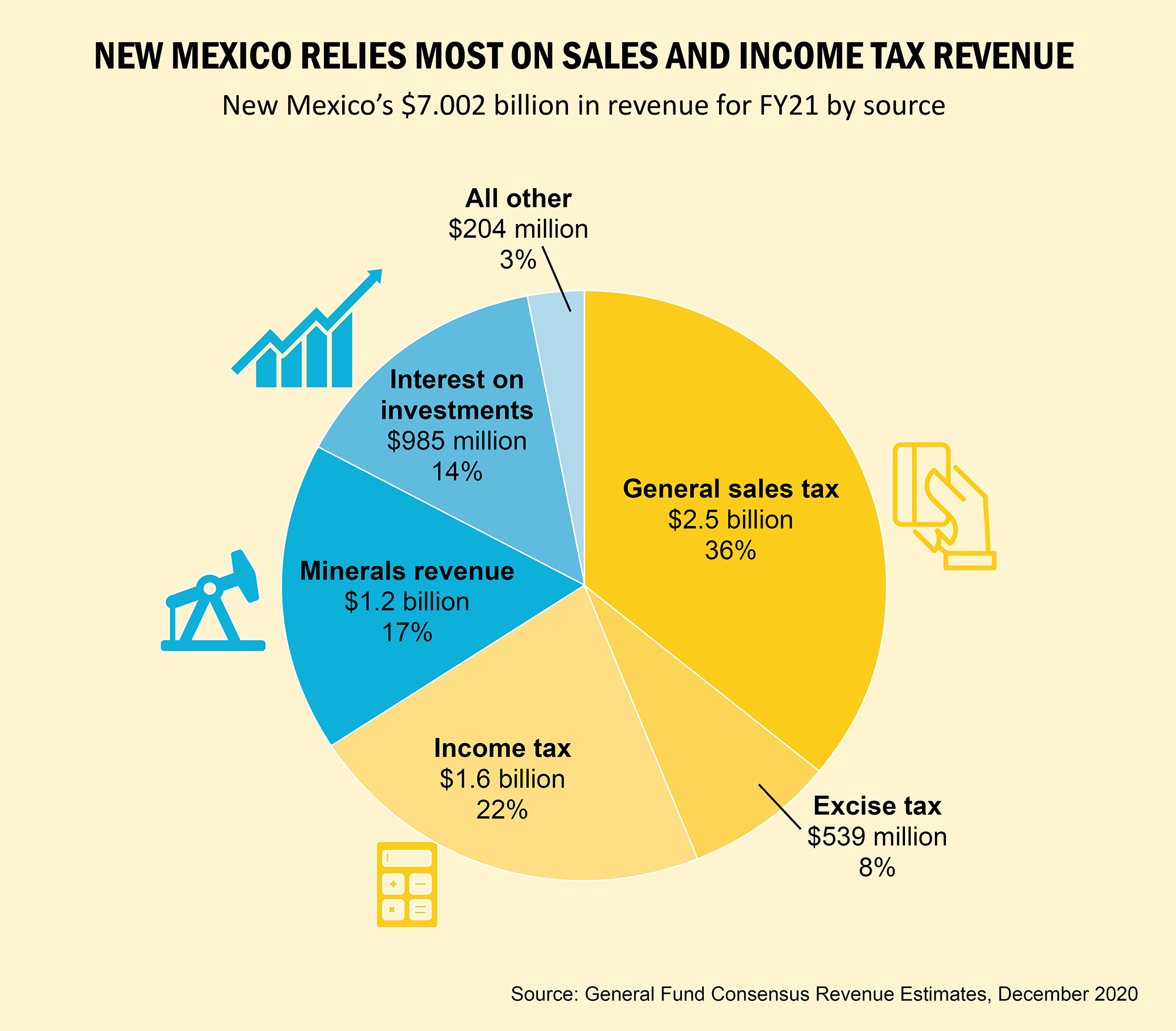

A Guide To New Mexico S Tax System New Mexico Voices For Children

What Is The Federal Solar Tax Credit Sunpower

Solar Panels New Mexico Cost Info Tax Incentives Solar Action Alliance

New Mexico Solar Company New Mexico Solar Panels Adt Solar

Federal Solar Tax Credit Being Reduced After 2019 Solar Technologies

Almost 2 000 Solar Tax Credits Approved In New Mexico

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

New Mexico Solar Incentives New Mexico Solar Company

U S Energy Information Administration Eia Independent Statistics And Analysis

Solar Power In New Mexico All You Need To Know

The Best Solar Companies In New Mexico Top Solar Installers Nm 2021

New Mexico S Solar Tax Credit Is Back And It Can Save You Thousands

Investment Tax Credit For Solar Power Solar Tax Credits Solar Power